CAA Travel Insurance Asian Community Guide

physician to call CAA Assistance for approval in advance, except in extreme circumstances where such action would delay surgery required to resolve a life-threatening medical crisis. 6. During a medical emergency (whether prior to admission or during a covered hospitalization), the Insurer reserves the right to: a. transfer you to one of our preferred health care providers; and/or

CAA Insurance Member Savings and Benefits Preferred Insurance

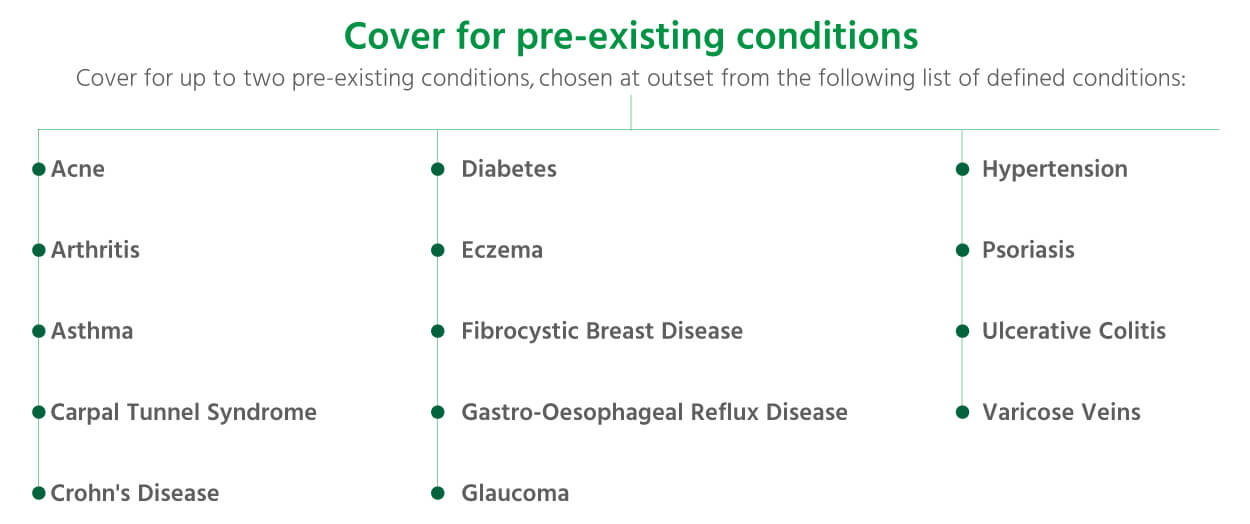

Travel insurance distributed by CAA-Quebec allows you to add an option to your policy to cover a pre-existing medical condition. No additional questions about your health will be asked. Your condition simply needs to be stable for seven days prior to departure in order to be covered.

Preexisting Condition Insurance

• This insurance contains limitations and/or exclusions (e.g.: Medical Conditions that are not Stable, pregnancy, child born on trip, excessive use of alcohol, high risk activities). • This insurance may not cover claims related to Pre-Existing Medical Conditions, whether disclosed or not at time of policy purchase.

How To Buy Travel Insurance If You Have PreExisting Medical Conditions?

What Does CAA Travel Insurance Not Cover? Coverage limitations depend on the policy details, but one thing to be aware of is pre-existing medical conditions. When you get a quote, you will be asked about this. You can add Pre-Existing Health Condition coverage, which provides $200,000 for an unstable pre-existing condition.

Member Travel Benefits CAA Niagara

A pre-existing condition is a medical condition (or conditions) that exists prior to your departure date. It includes a medical condition undergoing investigation or one that you have been diagnosed with or are receiving medical treatment for.. Yes, CAA Travel Insurance offers a top-up product that will allow you to purchase the additional.

FAQ Health Insurance & PreExisting Conditions YouTube

Subject to change without notice. 2 Up to $5 million CAD. Maximum $25,000 for all Emergency Medical Insurance benefits for Canadian residents without active Government Health Insurance Plan (GHIP); and/or without GHIP authorization to cover trip days in excess of 212 days in Ontario in a 12-month period. 3 To have your pre-existing medical.

CAA Travel Insurance Vector Logo Free Download (.SVG + .PNG) format

Pre-existing medical conditions don't need to hold you back from travel anymore. CAA Travel Insurance offers emergency medical plans with a Pre-Existing Medical Condition Rider so you can travel safely, sooner.

CAA Home Insurance Quote CAA Manitoba

During my trip. If your condition was stable before you left and your insurer agreed to cover you without excluding cancer, you will be covered. If you purchased emergency medical care coverage, you will be reimbursed for any such care received. If you have trip interruption coverage and a doctor as well as your insurer recommend that you.

Sponsored content How CAA travel insurance helped one Ottawa woman Ottawa Citizen

CAA Travel Insurance EducateMe. Travel safe and travel smart with everything you need to know about vacation planning, travel insurance and the latest travel advice and advisories. Call 1-800-437-8541 for questions. Travel Insurance FAQs. Checklist and helpful tips.

My CAA Insurance CAA Member benefits, Auto, Home & Travel Insurance caa basic membership,

RBC Travel Insurance: For travellers over age 75, the TravelCare package may cover pre-existing conditions, depending on your answers to a medical questionnaire. Scotiabank Travel Insurance.

Order a TripTik CAA Niagara

For example, with CAA-Quebec Travel Insurance, persons who wish to purchase medical care coverage require 3 or 6 months of stability. But if someone is under 60 and only wishes to buy cancellation insurance, there is no stability period required.. However, with CAA-Quebec's optional coverage for a pre-existing condition, you can leave.

Does Group Health Insurance Cover Pre Existing Conditions?

8 Multi-Trip Vacation Package Plan covers 4, 8, 15, or 30 days per trip depending on the plan purchased. Top-Up coverage is available for longer trips. Coverage cannot exceed 365 days from departure date or effective date. There is a maximum travel coverage of 63 days including Top-Up for travellers aged 60 to 84 years of age. Compare CAA.

Preexisting Medical Conditions Cover Private Health Insurance

travel confidently on their terms." CAA's Pre-Existing Condition Rider can be added to any of CAA's medical plans, and covers pre-existing conditions such as diabetes and high blood pressure with $200,000 in coverage per trip. Typically this kind of condition would not be covered unless it has been stable for at least three

The Travel Insurance You Could Be Missing CAA South Central Ontario

Let's get you connected with your Club . Services are different depending on where you live in Canada. Select your region and we will direct you to your CAA Club site.

Pet Insurance And PreExisting Conditions What You Need To Know

• Travel insurance is designed to cover losses arising from sudden and unforeseeable circumstances. It is important that you read and understand your policy before you travel as your coverage may be subject to certain limitations and exclusions. • A pre-existing exclusion may apply to medical conditions and/or

Mammy’s got a new whisk 🍆😂 no need for a health insurance xx Mrs Brown's Boys

CAA offers three travel insurance plans: Emergency Medical + Trip, Medical and Trip. Emergency Medical + Trip: This is the most comprehensive plan that includes coverage for medical emergencies.

- Bed And Breakfast Crowsnest Pass

- Formulaire De Demande D Asile Au Canada

- Soupe Aux Boulettes De Viande

- 2 Bedroom Apartment For Rent Charlottetown Pe

- John Deere Grain Moisture Tester

- Duplex For Sale Edmonton Under 300k

- Location Au Mois Sans Bail Québec

- Expedition 900 Ace Turbo R

- Western Props Blowing In The Wind

- Cottages For Sale On Rice Lake Ontario