Bad Credit Car Leasing Options House of Cars Calgary

The average credit scores for those who got a lease at the in the first quarter of 2023 were 736, compared to 742 for new car financing and 677 for used car financing, according to the Experian State of the Automotive Finance Market report. When you lease, you're paying for the car's expected depreciation during the lease term, along with a.

Bad Credit Car Leasing Lease Cars From £99pm

The minimum credit score required to be eligible for a loan will vary by dealer, but most look for a score of at least 661. This is on the low end, and many dealers look for scores of 700 and.

Leasing a Car With Bad Credit (10 Super Helpful Tips)

Leasing a car with bad or no credit is possible, but it's not going to be an easy route. The hard part is finding a dealership that will approve your lease application. When you apply for a lease, the car dealer will run a credit check to make sure that you're qualified. Buyers with excellent credit scores generally receive the best deals.

Can You Lease a Car With Bad Credit? Bad Credit Car Leasing Guide

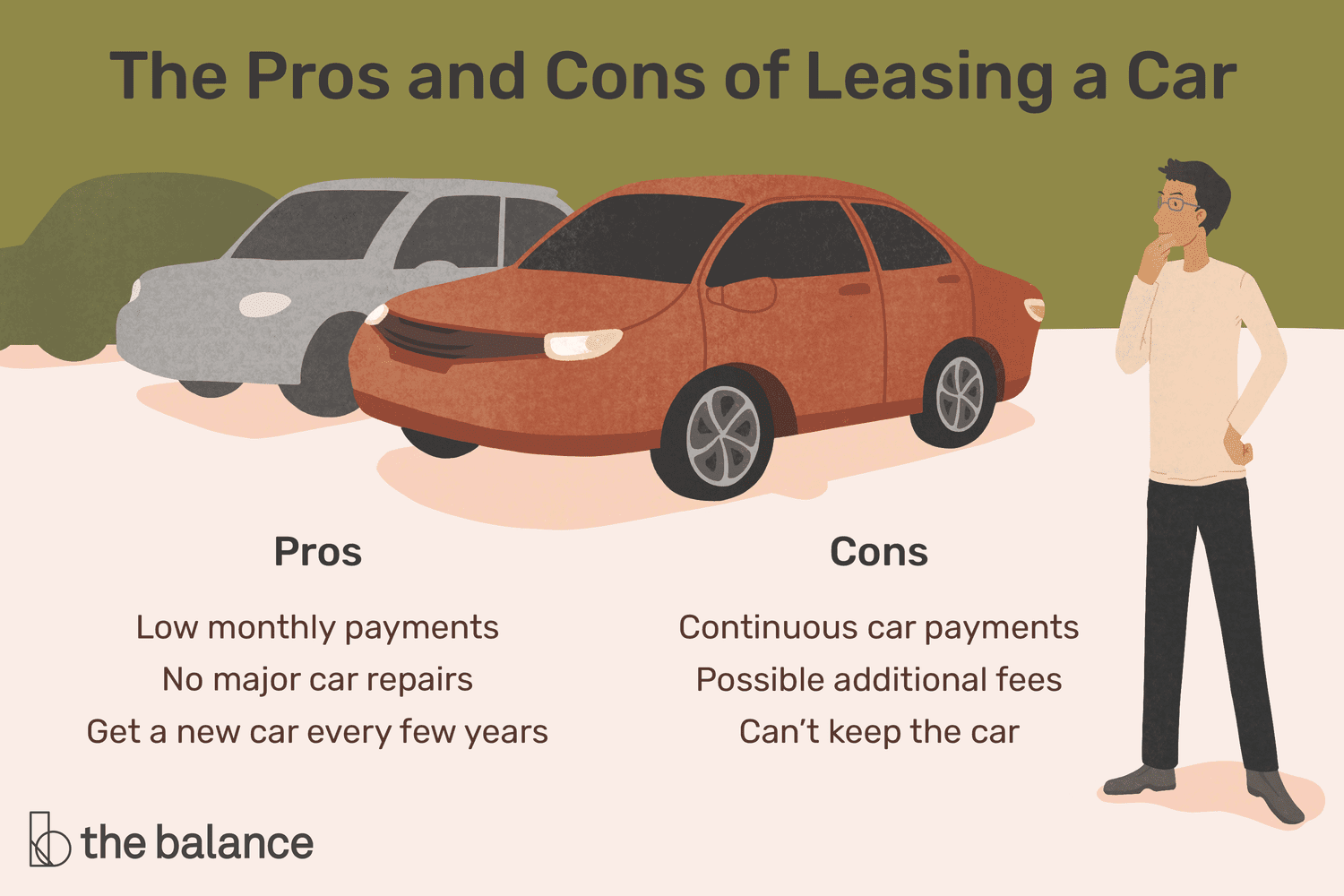

Auto Leasing Costs and how Poor Credit Can Affect Them. When you lease a car, you're essentially agreeing to rent it for a fixed number of months (36 is typical), with the understanding that you'll return it to the dealer in "like-new" condition at the end of that period. Lease payments are based on two factors: 1) The amount of value the car.

Bad credit car leasing why your credit rating matters Parkers

Though there is no set credit score limit for leasing a car, "usually a score between 670 and 739 is required," says Jacob Dayan, CEO, and co-founder of Community Tax and Finance Pal. "A.

What Is Leasing a Car and How It Works? Lease a Car Direct

What to know when leasing a car with bad credit. If you do qualify for a lease with bad credit, those low credit scores could affect the terms of your lease. For example, the dealer might require you to pay a bigger security deposit or down payment. Or you might be charged a higher interest rate—known here as the "money factor" or.

The Pros and Cons of Buying vs Leasing a Car Century Of Money Money and Investing

3. Take over another lease. Taking over an existing lease is one final way to get a lease with no credit. Instead of going through the leasing company directly, you approach a leaseholder about.

Leasing a Car with Bad Credit Signature Auto Group Florida

Because credit scores play a significant role in the leasing process, having bad credit can make it more challenging to lease a car. It can also affect the terms of your lease. Ultimately, the decision to lease a car with bad credit should be made after carefully considering your financial situation, your vehicle needs and the lease agreement.

Bad Credit Car Leasing How To Lease Cars With A Low Rating

According to the credit experts at Experian, in the fourth quarter of 2021, consumers with a credit score between 601 and 660 made up nearly 14% of the leasing market. Those with a credit score below 600 represented just over 5%. In other words, about 19% of lessees at the end of 2021 posted credit scores of 660 or lower.

Why is car leasing a bad idea? OSV

Start by Phone - Call: (855) 439-0814. Online Loan Request Form: Start Here. A negative credit history can make it hard for anyone to acquire a new vehicle. However, leasing a car with bad credit is possible if you are able to contact the right lender and fully understand the leasing process.

How Leasing a Car Works A Comprehensive Guide The Tech Edvocate

You can get the lease from someone you know or use a website to find drivers looking to transfer their leases to someone else. However, you still need to get your credit approved if you pursue.

Contractul de leasing auto ce este, avantaje si dezavantaje

How does bad credit affect car leasing? Your credit score is basically a snapshot of your financial history and behavior. It's a reflection of how likely you are to repay borrowed money, whether it's a car lease, a loan, or a credit card.. Some users' scores may not improve. Results will depend on many factors, including on-time.

Bad Credit Car Leasing How To Lease Cars With A Low Rating

Disadvantages of leasing a car with bad credit. Some challenges you might face when trying to lease a car with bad credit include the following: 1. Higher interest rates. Those with lower credit scores may find leasing less affordable due to higher interest rates, resulting in increased monthly payments. 2.

Get Loan Even With Bad Credit History With Car Title Loans Markham by Approve Loan Issuu

To increase the chances that this approach will work, the co-signer should have a minimum credit score of 670 or better, says Sexton. Keep in mind that skipping payments can cause trouble for your.

Car Leasing Bad Credit Birmingham 0800 689 0540 YouTube

Pay bills on time and set up automatic payments wherever possible. Set up payment plans with creditors if necessary. Limit applying for new credit, as doing so requires a hard credit check, which.

Does Leasing a Car Build Credit? Self. Credit Builder.

September 24, 2021. You can lease a car if you have spotty credit, but it won't be easy — and you probably won't get the alluringly low lease payments you see advertised. Related: Lenders.