Severance indemnity what is the Severance Pay

Within 48 hours after the last day an employee works when an employer ends employment. Within 6 days after the employee's last day of work when an employee quits. If an employee cannot be located, the employer must pay the wages to the Director of Employment Standards within 60 days of the wages being payable.

Is Severance Pay Taxable?

Quitting or getting fired. Employees can quit their job at any time. If an employee quits their job, they're not paid compensation for length of employment. Employers can end an employee's job by giving written working notice or pay (called compensation for length of service). They can also choose to give a combination of both notice and pay.

Severance Pay Ontario McMackin Law

How much severance pay do I get if I'm fired without cause? In British Columbia, the amount of severance pay you might receive after being terminated without cause can vary based on several factors, such as the length of employment, employee age, and type of job. The minimum amount of severance pay you are entitled to could be one week's pay up to 8 weeks.

Termination Pay vs Severance Pay in Ontario Dutton Employment Law

For 12 months of consecutive employment, at least 2 weeks' notice or pay is required. For 3 years of consecutive employment, an additional week's notice or pay for each additional year of service is required, up to a maximum of 8 weeks. It should be duly noted that no current law, even the ESA, establishes an exact formula for severance pay.

Severance Pay by Youri Hwang SVA Design

The ESA in B.C. establishes the minimum amount of severance pay that an employee is owed when they are let go from their job without cause. The amount of severance pay you will receive depends on your length of service as an employee: After 3 months of service: 1 weeks' pay. After 12 months of service: 2 weeks' pay.

asking for fair severance pay after got termination from company vector 7386645 Vector Art at

How much severance pay is an employee entitled to in BC? The amount of severance pay an employee will receive depends on their length of service. The British Columbia Employment Standards Act lays out the minimum amount of severance pay that an employee is owed as follows: After serving three consecutive months of employment, an employee is.

What Employers Need to Consider About Severance Pay Paychex

Are you trying to determine if your severance package is fair? Contact the firm or call 1-855-821-5900 to secure assistance from an employment lawyer in Ontario, British Columbia or Alberta. Get.

Severance pay or redundancy pay know your rights & law in UK

Receiving Employment Insurance (EI) benefits and severance pay in B.C. has tax implications. EI benefits are taxable income, meaning they are subject to federal and B.C. taxes. You'll receive a T4E slip from Service Canada for the EI benefits received, which must be reported on your income tax return. Severance pay is also considered taxable.

Legal Guide to Severance Pay and Severance Packages Rocket Lawyer

However, once a seasoned employment lawyer has the facts, the appropriate severance amount can be determined fairly quickly. To learn more about severance in your own situation, contact the writer, Jonas McKay, or any of the HHBG Lawyers at 604.696.0556 to schedule an appointment. Back to blog.

Severance Pay Calculator Ontario Calculating Severance Pay Ertl Law

In British Columbia, you do not have any entitlement to severance under the Employment Standards Act if you have been employed with your employer for less than three months. At the three month mark, you might be able to claim severance pay if an employer terminates your employment. The amount of compensation increases with each year of.

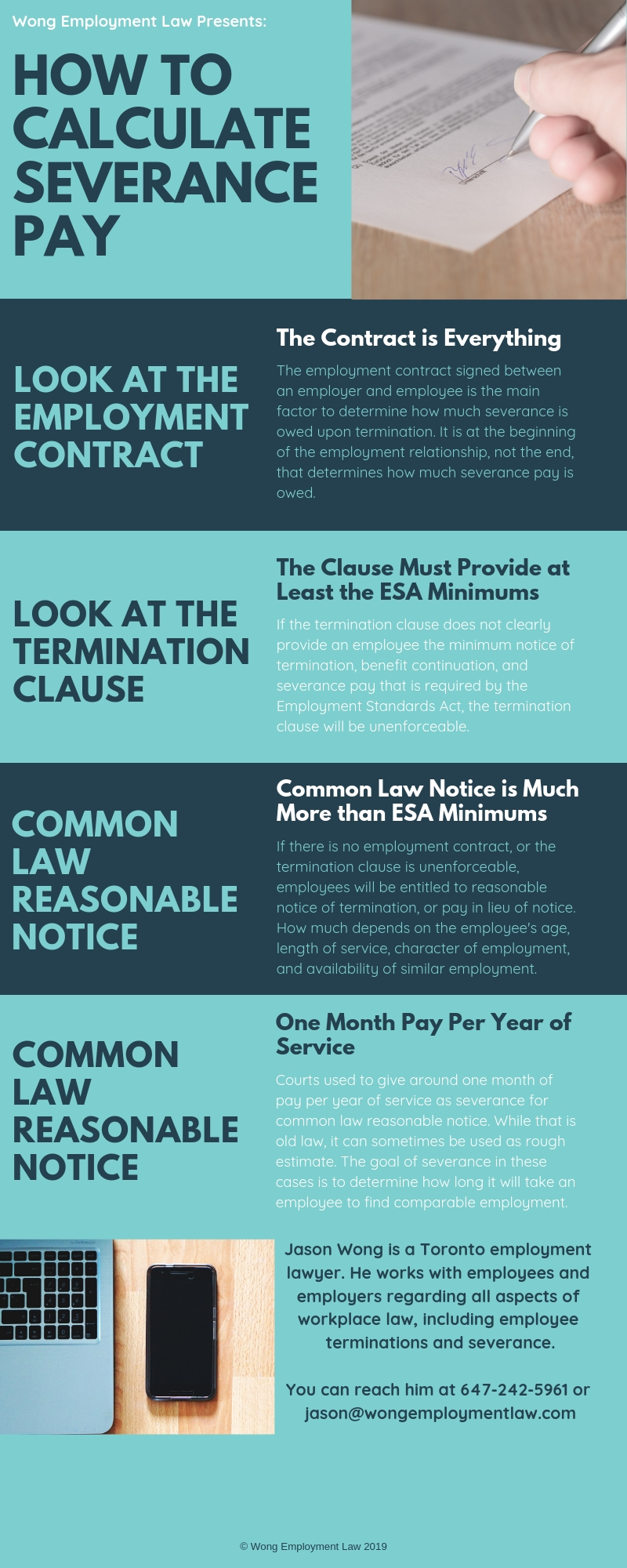

How to Calculate Severance — Wong Employment Law

How is severance pay paid out? If you are entitled to severance pay, you may be paid out in the form of a lump sum payment, a salary continuance, or payments over time. The amount may depend on how much. You may be required to pay income tax on your severance payments. We recommend speaking with an accountant to better understand your tax.

How Can A Lawyer Help You Get Your Severance Pay?

At Taylor Janis LLP, we have the skills, knowledge, and expertise to handle all of your employment & labour law needs. Our Vancouver intake staff are standing by to help you. Call 604-423-2646 [toll free 1 (877) 402-1002] or contact us online for general inquiries. We also have a dedicated intake form to help you get the ball rolling.

New Severance Rules Sheer Velocity

The accurate, anonymous and FREE severance pay calculator tool that has been used by over 1,000,000 people to calculate their possible severance package in Ontario, BC and Alberta. Use the Severance Pay Calculator

Severance Lawyer Allen, TX Plano, TX Frisco, TX Law Offices of Dan A. Atkerson

You may be entitled to receive a severance package from your employer. How Does Severance Pay Work? In terms of BC employment law, your employer is generally required to provide you with a sufficient notice period before terminating your employment agreement. According to the Employment Standards, the following notice periods…

How are severance pay and severance pay calculated? Div Bracket

Here are some steps you can follow to determine your severance pay: Identify how many years you've worked with the company. Determine your average weekly pay. Multiply the number of years by your weekly pay to determine your severance pay. For example, if Jill typically works 40 hours per week and makes $20.00 per hour, her average weekly pay.

Counterpoint Severance Pay The World of Chinese

What You Need to Know About Severance Pay. An employee that is let go from their job - also known as termination without cause in Ontario, Alberta and B.C. - is entitled to compensation. This is referred to as severance pay in Ontario, severance pay in B.C., severance pay in Alberta and termination pay or pay in lieu of notice. How much compensation, depends on a number of factors.

- Chihuahuas For Sale In Ontario

- Liberty Of London Fabric Canada

- Academy Dental Fort Street Victoria Bc

- St Peter Church Winnipeg Mass Times

- Condos A Vendre A Gatineau

- Salade De Chou Di Stasio

- 30 Ton Pneumatic Hydraulic Bottle Jack

- Bc Cross Country Championships 2023

- Grady White For Sale Bc

- 22 East Cordova Street Vancouver Bc