NR4! YouTube

1 Best answer. CarolynB. New Member. To enter the NR4, treat it as if it is a SSA-1099 and enter it in the Retirement Plans and Social Security section, under 'Social Security (SSA-1099, RRB-1099)'. Then, go to the Deductions and Credits section and select Foreign Taxes under 'Estimates and Other Taxes Paid' to enter any foreign tax you.

lucrarea de laborator Nr4конвертирован

The payer has to provide non-resident NR4 slips including the gross rental income and the tax withheld on an NR4 slip. The payer is required to submit NR4 to CRA on or before the last day of March of the following year to which the rental income applies. Table to decide if you need to file an NR4 slip based on the total gross income and tax.

KarteNr4 Marianum News die OnlineSchülerzeitung

Accessible Fillable PDF (nr4-fill-23e.pdf) Print and fill out by hand. Standard print PDF (nr4-23e.pdf) Ask for an alternate format. You can order alternate formats such as digital audio, electronic text, braille, and large print. Order alternate formats for persons with disabilities; Related documents. Using PDF forms

Taczka Nr4

Box 17 to 27 - Non-Resident Tax Withheld. Enter in Canadian funds the amount of non-resident tax you withheld. If you cannot convert foreign funds to Canadian currency, complete box 15 or 25 (Currency code), in order to clearly indicate on the NR4 slip the currency of the tax you withheld.

Biblioteczka sosnowa nr4 biała cena, sklep Magnat

Box 16 or 26 - Gross income. Box 17 or 27 - Non-resident tax withheld. Box 18 or 28 - Exemption code. Non-resident recipient's name and address. Name and address of payer or agent. Non-resident account number. Date modified: 2024-01-16. This page contains links on how to complete the various boxes on the NR4 slip/.

NR4 NextRegister Installation Support Center

This guide explains how and when to withhold non-resident tax, how to remit it and how to file the NR4 return.

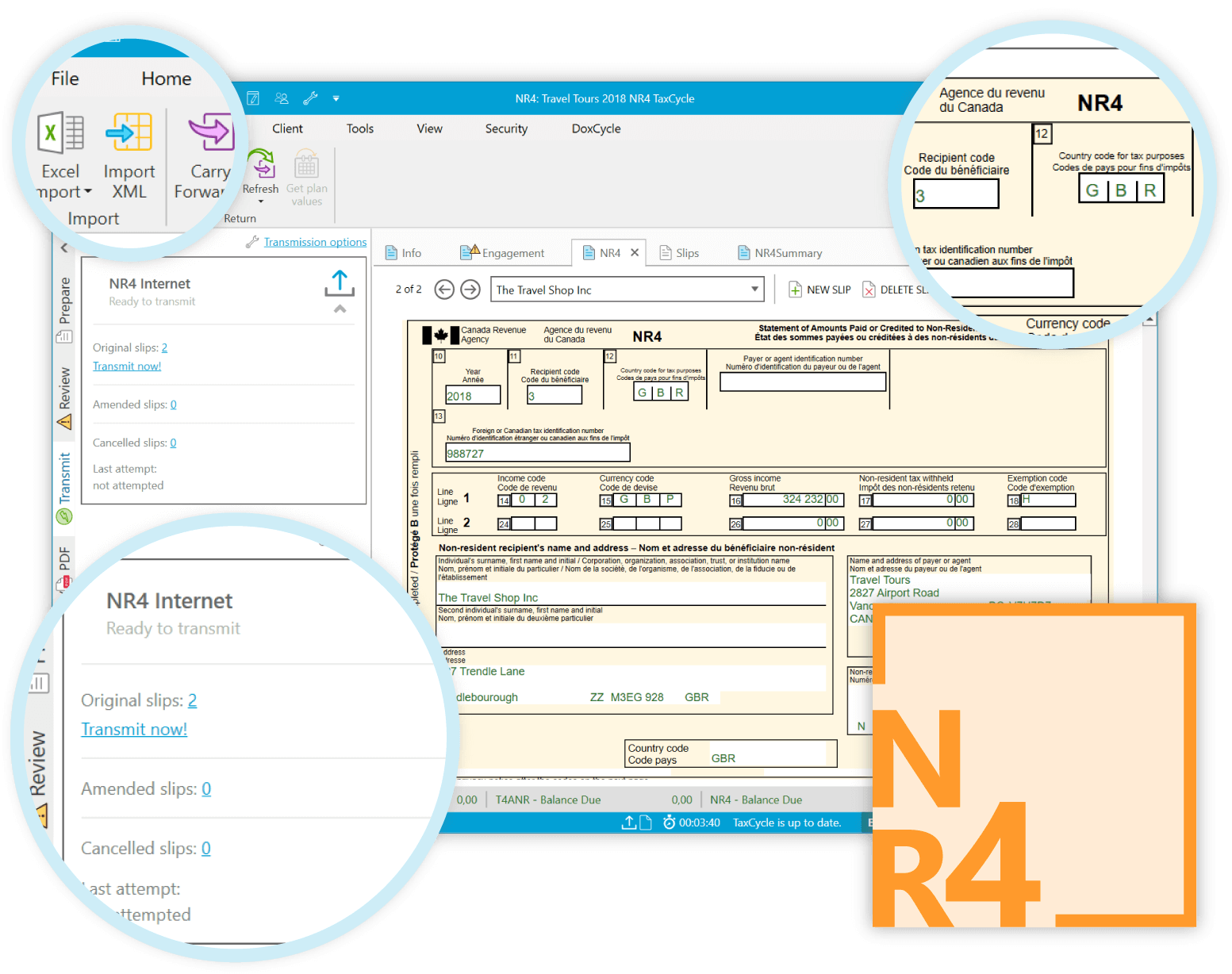

TaxCycle NR4 TaxCycle

Amounts paid or credited to non-residents of Canada. Issue NR4 slips to recipients and file the related issuer summary with the Canada Revenue Agency (CRA). Prepare and electronically file unlimited federal NR4 slips and summaries. TaxCycle NR4 is included in the Complete Paperless Tax Suite and is also available as a stand-alone module.

NR6 Form AwesomeFinTech Blog

When to fill out an NR4 slip. Filling out the NR4 slip. Distributing copies of the NR4 slips. Amending, cancelling, adding, or replacing NR4 slips. Date modified: 2024-01-16. This page contains information about the NR4 slip when payments are made to non-residents.

Schloss Basedow Nr4 Online Shop Alter Schafstall Basedow

The enclosed NR4 slip records the various types of Canadian source investment income received in your RBCIS account for 2023, and also identifies the Canadian non-resident tax withheld on this income over the. form and file it with the CRA to obtain a refund of the excess tax paid on that portion of the trust's distributions. Please also.

Nadstawka drewniana nr4 szer. 120cm sosna cena, sklep Magnat

Canada. Fill out one copy of the NR4 slip for each non-resident and send them to the CRA with your NR4 Summary. Enter the information for two different non-residents on one sheet. You must keep the information from the NR4 slips and the NR4 Summary or a copy of these forms for your files.

Junee Trains NR4, NR84 & NR115 YouTube

5- On the page that appears, enter the details of your situation. 6- Return to the left side menu on the " Interview tab " and select " T4A and pension income". 7- On the screen to your right, choose " T4A (OAS) - Old age security pension income " and enter the amounts in the corresponding fields. The program will generate Schedule C.

NR4, NR7 EA an order to develop the trading robot at Freelance service Budget

Once approved you must file under Section 216 for that year, despite receiving a refund or owe any money. Upon approval by the CRA, your property manager/agent can withhold the non-resident tax of 25% on your net income. Taxes are due on the 15 th day of the following month after rental income is paid to you. Example : Rent is due on March 1st.

Nr 4 2019 / Digital Publikation Samverkan 112

The amount in the NR4 form is in Canadian dollars, so convert it to U.S. dollars before you enter it in your U.S. tax return. Sign into TurboTax and go to your U.S. tax return. Type "1099-R" in.

پمپ گردشی کالپدا Calpeda NR(D)NR4 خرید قیمت مشخصات ویژگی

If you are a resident of Canada and you received an NR4 slip: Report the income on your tax return. You'll need to "convert" your NR4 into the correct type of slip. Use the income code (in box 14) to determine what kind of slip to use in Wealthsimple Tax. You can't claim "non-resident tax deducted" on your Canadian tax return.

Szafa sosnowa 4D nr4 S180 biała cena, sklep Magnat

NR4 - Non-resident tax withholding, remitting, and reporting .: Rv1-35E-PDF "This guide gives information for payers and agents who make payments to non-residents of Canada for income such as interest, dividends, rents, royalties, pensions, and acting services in a film or video production. It also explains how to fill out the NR4 slip and.

NR4 NextRegister Installation Support Center

Table to help you decide if you need to file an NR4 slip Recipient Type of recipient based on the total gross income and the tax withheld code Total gross Report 1 individual income paid Tax amounts on 2 joint account or credited NR4 slip 3 corporation Less than $50 Tax withheld Yes other (for example, association, trust, Less than $50 No tax.