Notice of Assessment Campbell County, WY Official Website

an assessed return, notice of assessment or reassessment, other tax document or be signed in to My Account; If you are calling the CRA on behalf of someone else, you must be an authorized representative. Telephone number. 1-800-959-8281. Yukon, Northwest Territories and Nunavut: 1-866-426-1527. Outside Canada and United States (Eastern Standard.

Madeleine Pring Do You Need A Sample Notice Of Assessment?

Line 150 / 15000 your Notice of Assessment indicates your total income for the tax year.

After sending us your tax return Learn about your taxes Canada.ca

Line numbers that were three or four digits are now five digits (for example, line 150 on the return is now line 15000), and the former Schedule 1 is now part of the return. Representative authorizations - A new e-authorization process for online access to individual tax accounts will be introduced February 10, 2020. You will be able to.

How to download your Notice of Assessment in your CRA My Account? My Rate Compass

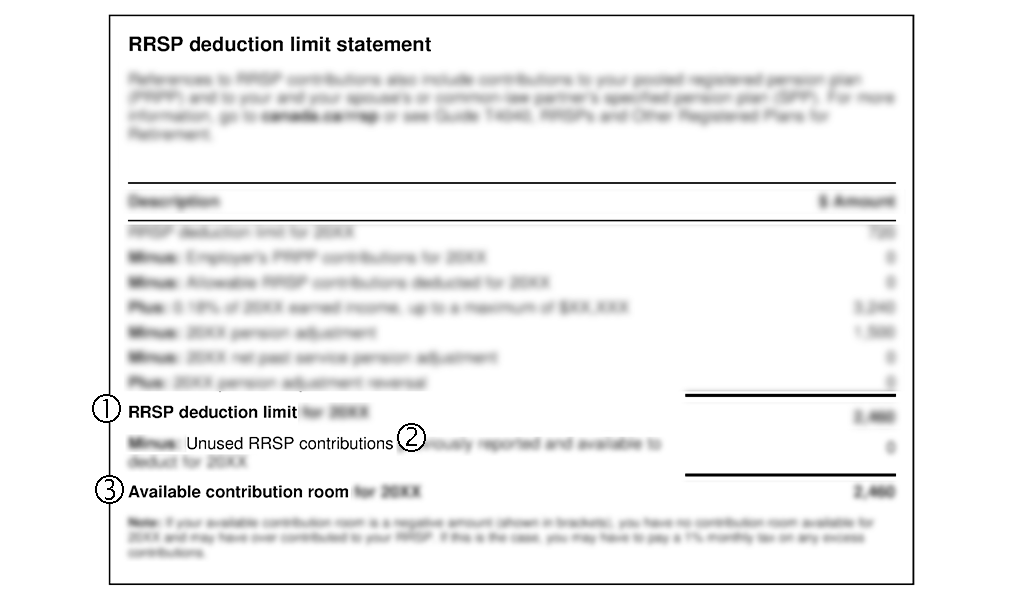

If line 15000 (150 for 2018 and prior years) in your most recent return or notice of assessment includes pension or RRSP income, then you may need to adjust that income. You cannot deduct the amount you put into an RRSP or any other pension plan from the amount of income used to calculate child support.

Articles Understanding the CRA Notice of Assessment Fund Library

Your notice of assessment shows the balance left to repay and the minimum amount to repay for the next year. You can find your notice of assessment or reassessment online in your CRA MyAccount, or by mail. When you receive your assessment, it's important to compare it with your copy of your tax return, to see where any changes were made, if any.

VeriDoc Global. VeriDoc Global Use Case Breakdown Notice Of Assessment

Use Line 15000 from the most recent CRA Notice of Assessment to determine gross household income. Subsidy for 0 to Kindergarten-age (child care during school hours) Under the new federal-provincial child care agreement , all parents of children 0 to kindergarten-age (in kindergarten and also attending child care during regular school hours) will pay less for child care through:

Assessment appeal Placer County, CA

use your total income on line 15000 of your Notice of Assessment (NOA) from the Canada Revenue Agency (CRA) and; subtract any income that must be excluded: provincial or territorial allowances for an instruction or training program (such as taxable scholarships, bursaries, or fellowships if included on line 13000 of the NOA)

How to download your Notice of Assessment in your CRA My Account? My Rate Compass

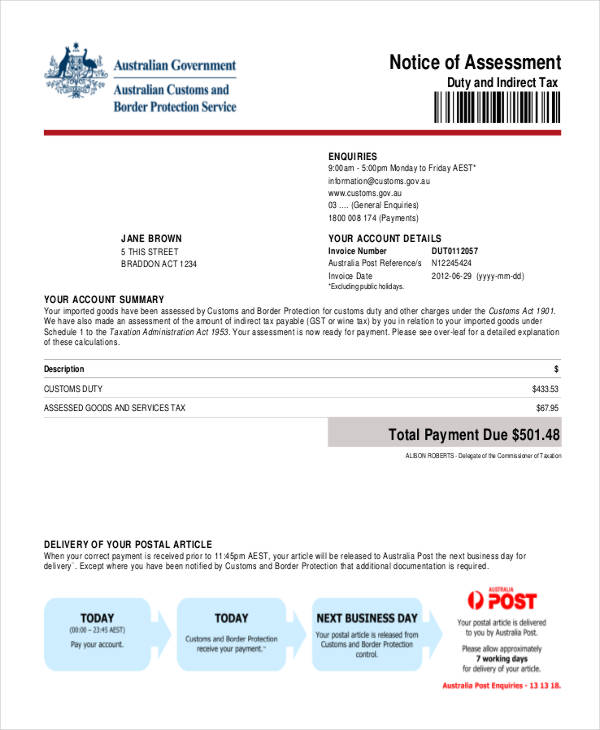

The Canada Revenue Agency (CRA) issues a document known as the Notice of Assessment (NOA) to taxpayers annually. This document is essentially an evaluation of an individual's tax return for the year, outlining their tax status as per the CRA's assessment. Typically, taxpayers receive their NOA a few weeks after submitting their tax return.

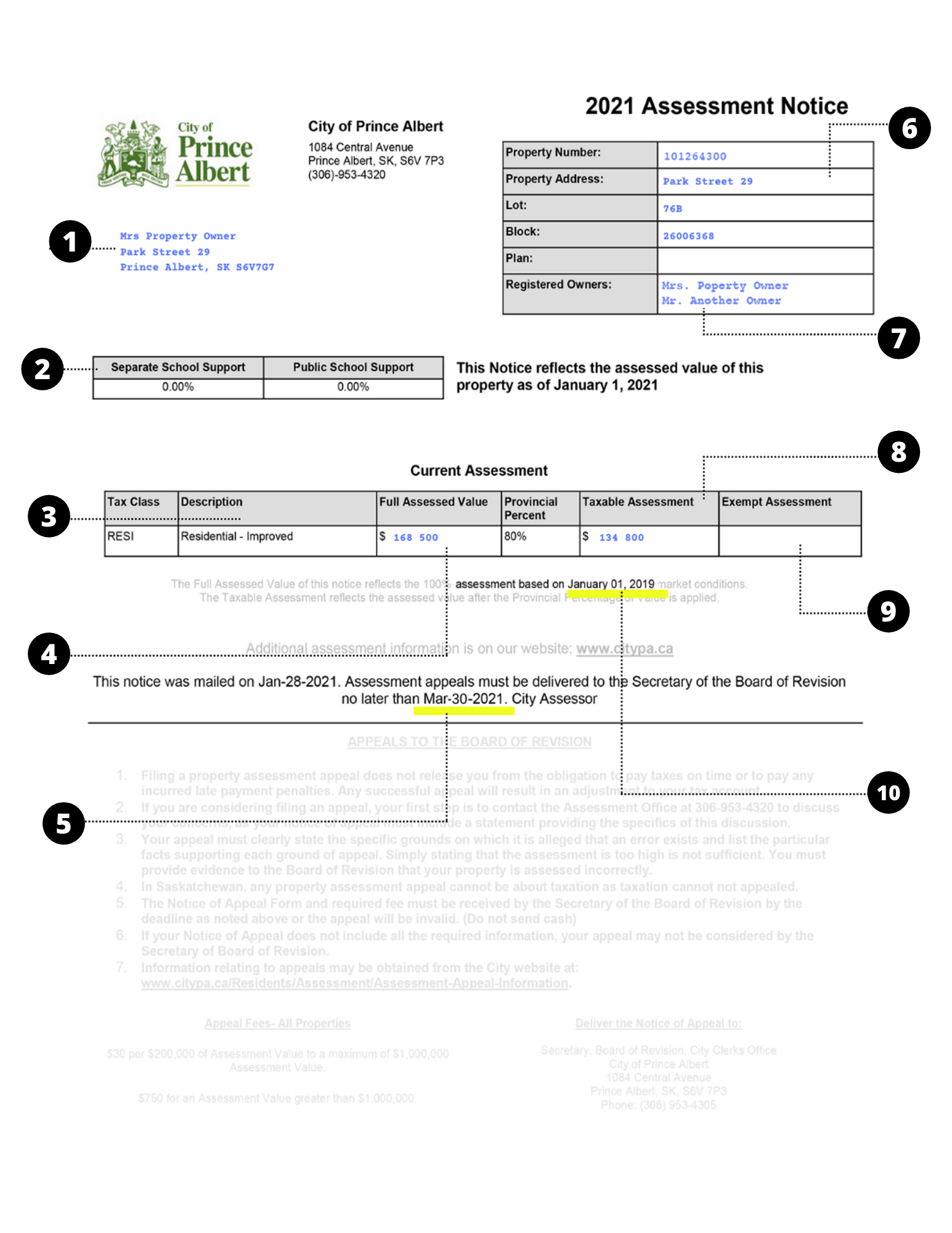

Understanding your Assessment Notice City of Prince Albert

In these cases, recipients of support often argue that the payor is, in fact, earning more income than is reflected on Line 150 of their Income Tax Return and Notice of Assessment. It is also interesting to note that there are cases where a party's Line 150 income is overstated. In the case of Stober v.

What is a Notice of Assessment (NOA) and T1 General? Filing Taxes

Refund or balance owing. Your notice of assessment (NOA) is an evaluation of your tax return that the Canada Revenue Agency sends you every year after you file your tax return. Your NOA includes the date we processed your tax return, and the details about how much you may owe, or get as a refund or credit. The NOA also gives your Registered.

Notice of Assessment Expert Fiscaliste

Apr 29, 2020. Line 15000 on your T1 tax return refers to your Total Income (gross) before you make any deductions (it used to be called line 150). To calculate the number on line 15000 on your tax return, all you have to do is add the amounts from lines 10100, 10400 to 14300, and line 14700. Keep in mind, this is not the income your taxes are.

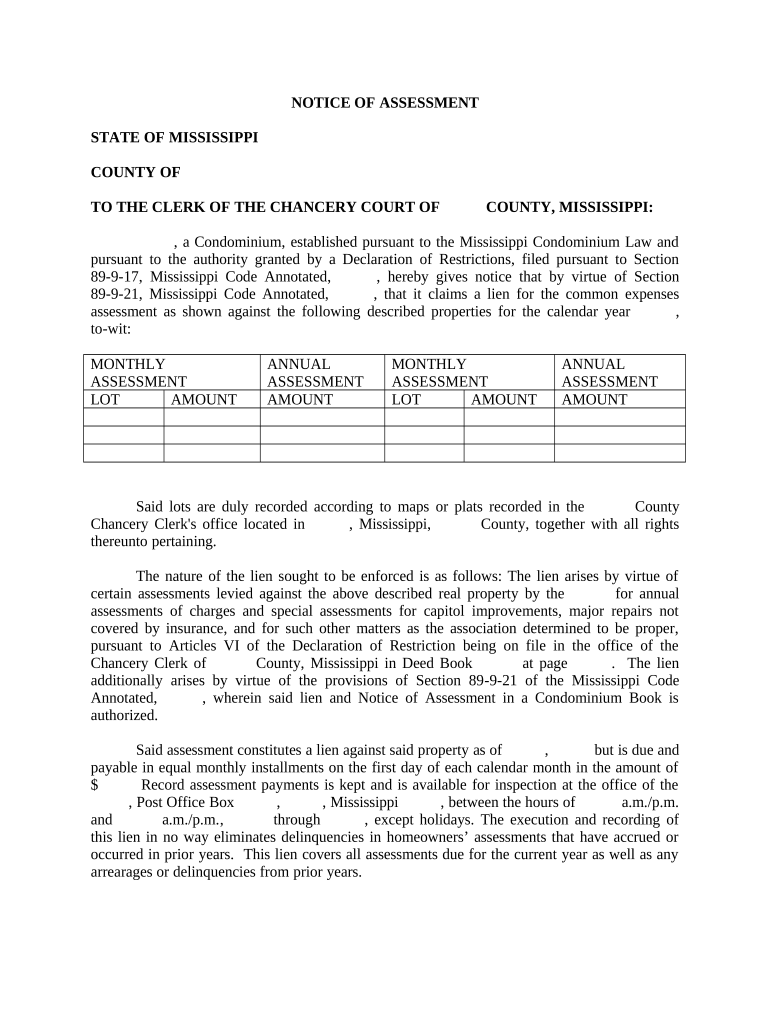

Notice Assessment Sample Form Fill Out and Sign Printable PDF Template SignNow

If " Line 150" is comprised only of employment income and there are no related adjustments, such as union dues, then " Line 150" and Guideline income are the same amount. However, if " Line 150" is comprised of $30,000 of employment income and $80,000 of taxable eligible Canadian dividends, the total is still $110,000 but Guideline income (barring any other considerations or.

Why is your Notice of Assessment important? YouTube

Learn what you'll need to know after submitting your taxes, including understanding your notice of assessment, how to pay a balance owing, make a payment arrangement with the CRA, or change your tax return.. Line 35000 Total federal non-refundable tax credits: 1,650 Line 61500 Total provincial non-refundable tax credits: 1,200 Line 42000 Net.

EAS Frequently Asked Questions QTAC

Line 15000 on your tax return lists your total income before deductions, otherwise known as your gross income. It includes not only your wages or salary from your T4 - Statement of Remuneration Paid, but also income from other sources that you may have received. What you make in a year is, after all, often more than just what your employer.

Legal Solution for Assessment & Reassessment Notice U/S 148 for Assessee

The answer is simply that the total of your income on Line 15000 (Line 150), will determine your taxable amount owing. You see CERB and EI add to your overall total income for the year. The higher your total income on Line 15000 the higher your tax bracket will be. Many tax filers this past year have been caught off guard not knowing that they.

Notice of Assessment Tax Form Federal Notice of Assessment in Canada 2022 TurboTax® Canada

You will need your date of birth, SIN and Line 1500 (used to be line 150) from last year's return on your Notice of Assessment. Contact information . Jak Pullen. Senior Portfolio Manager & Wealth Advisor [email protected] Phone: 780-944-8834 Toll-Free: 1-866-261-4565 . Jason Forster.