Statements Explained Definition and Examples Pareto Labs

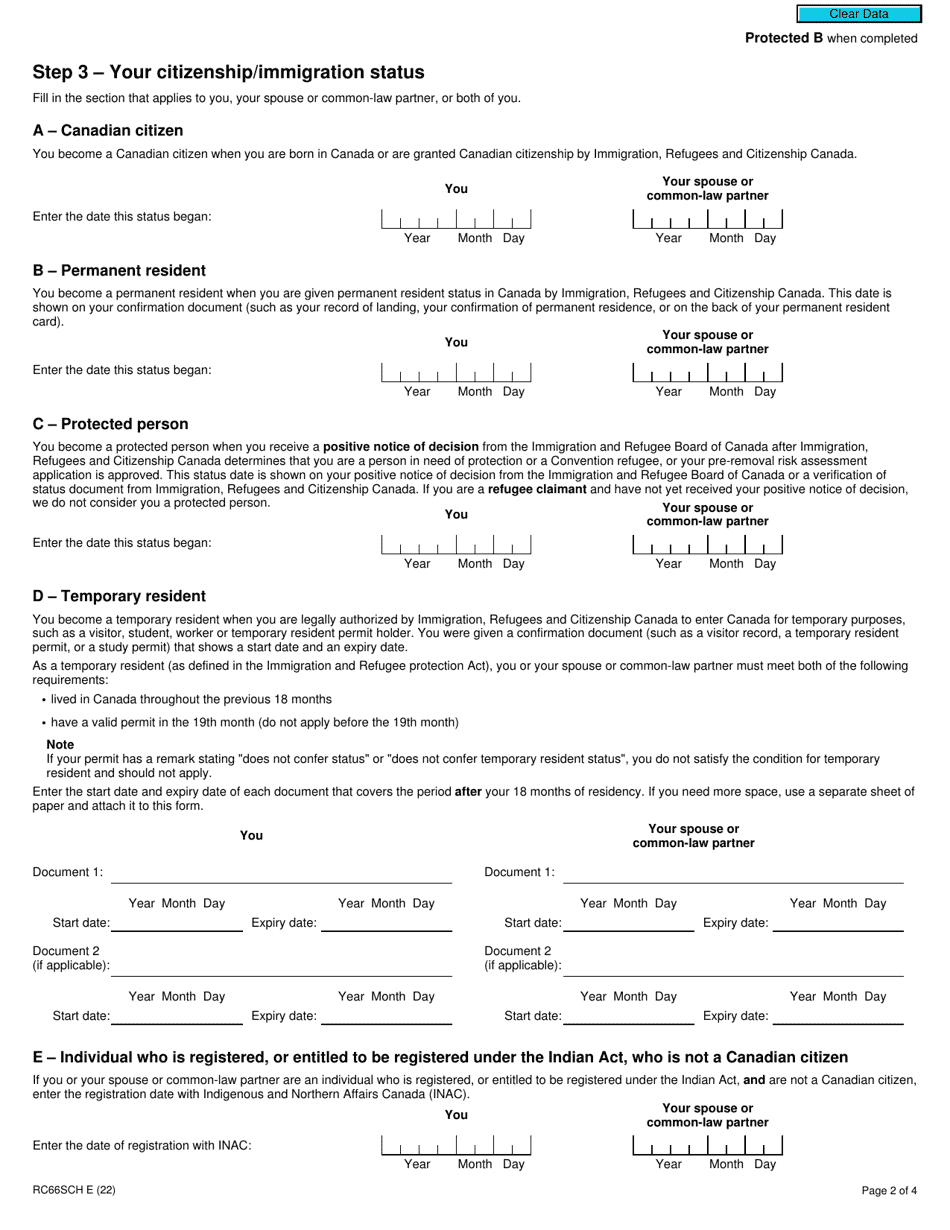

The Canada Revenue Agency (CRA) has designed form RC66SCH for those who are not Canadian citizens but who wish to apply for the Canada Child Benefit. For example, those who have just become a resident of Canada in the last two years or those who became a citizen of Canada in the last 12 months can use this form.

Form RC66SCH Download Fillable PDF or Fill Online Status in Canada and Information for

Fill out this form if any of the following situations apply. You, your spouse or common-law partner (if you have one), or both of you: In this form, you will provide information about your and your spouse or common-law partner's residency status, citizenship and immigration statuses, and income. This information is used to determine your child.

Pin on Awesome Accountants

Status in Canada / Statement of Income when completed Complete this schedule, and attach it to your Form RC66, Canada Child Benefits Application, if you or your spouse or common-law partner: • became a new resident or returned as a resident of Canada in the last two years; • became a Canadian citizen in the last 12 months; or

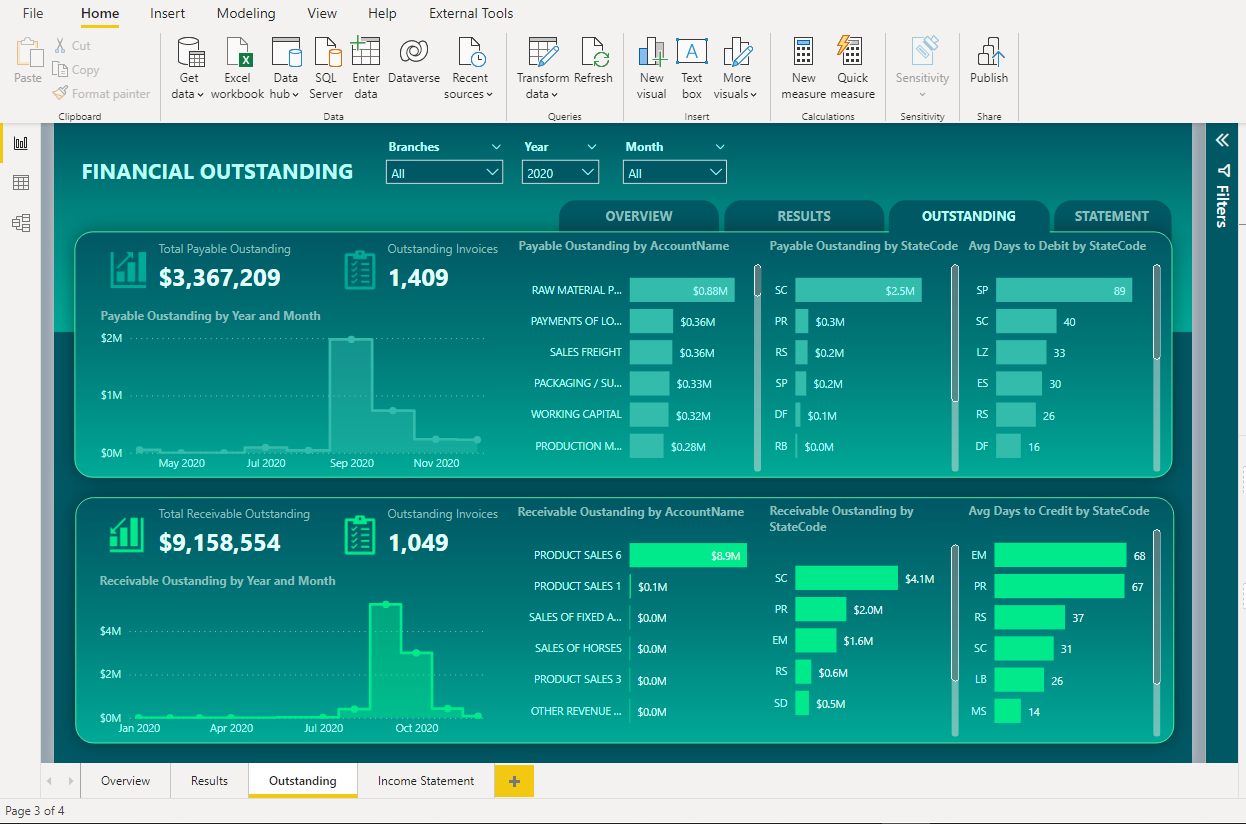

Statement Dashboard in Microsoft POWER BI Eloquens

Status in Canada / Statement of Income. when completed Fill out this schedule, and attach it to your Form RC66, Canada Child Benefits Application, if you or your spouse or common-law partner: • became a new resident or returned as a resident of Canada in the last two years; • became a Canadian citizen in the last 12 months;

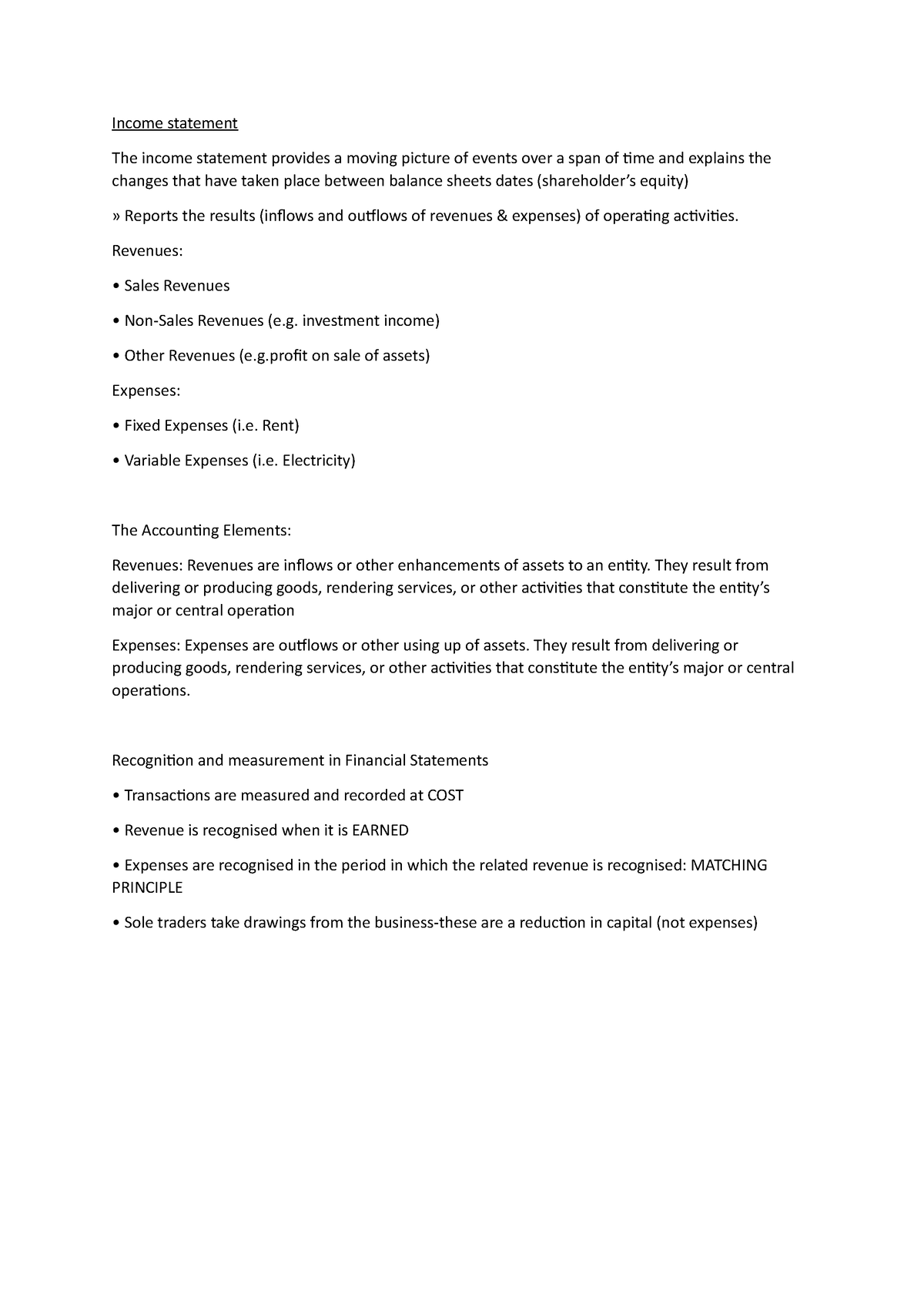

Statement statement The statement provides a moving picture of events

Fill out Form RC66, Canada Child Benefits Application and Form RC66SCH, Status in Canada and Income Information to apply for the Canada child benefit. No children? Apply for the GST/HST credit for you and your spouse or common-law partner by filling out the Form RC151, GST/HST Credit Application for Individuals Who Become Residents of Canada.

Form RC66SCH Download Fillable PDF or Fill Online Status in Canada and Information for

Fill PDF Online. Fill out online for free. without registration or credit card. Form RC66SCH Status in Canada is a Schedule that is used to provide income information for the Canada Child Benefits Application. This form helps the Canadian government determine if you are eligible for child benefits based on your income.

How to fill RC66SCH Form Canada Child Benefits Form A complete Guide YouTube

1. Figure out who should apply for CCB benefits 2. Apply for the Canada child benefit 3. Use the Automated Benefits Application, if this applies 4. Apply as soon as possible 5. Get a decision. You can apply for the Canada child benefit (CCB) by: mailing Form RC66 Canada Child Benefits Application to your local tax centre.

Pin on Data Science

We want to process your Form RC66, Canada Child Benefits Application, as soon as we can. Be sure to do the following: Checklist Complete schedule RC66SCH, Status in Canada/Statement of Income, if it applies to you or to your spouse or common-law partner and attach it with your application. Sign and date the application form.

What is included in the Statement? Statement Items Part1 YouTube

Proof of citizenship status (for example, a Canadian birth certificate) and/or immigration status in Canada for you and your spouse or common-law partner (if you have one). Proof that you resided in Canada, such as a lease or rent receipts, utility bills, or bank statements. Proof of birth for each child. See Part 3 of this form.

Canada New Immigrants How to Apply for Child Care Tax Benefit and the GST/HST Credit The

Canada child benefit. The Canada child benefit (CCB) is a non‑taxable amount paid monthly to help eligible families with the cost of raising children under 18 years of age. The CCB may include an additional amount for the child disability benefit.. By applying for the CCB, you also register your children for the goods and services tax/harmonized sales tax (GST/HST) credit, the climate action.

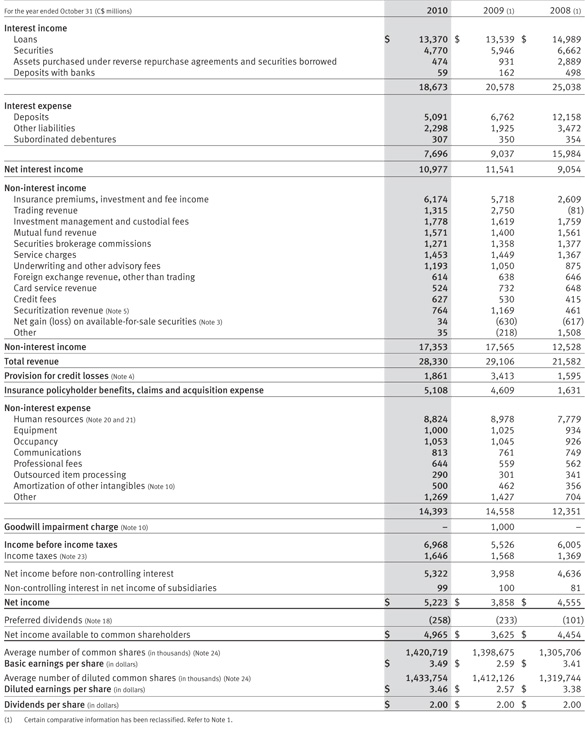

Royal Bank of Canada Consolidated Financial Statements

Step 2 - Your residency status. Fill in the section that applies to you, your spouse or common-law partner, or both of you. The date you became a resident of Canada is the date you established significant residential ties in Canada. This date is usually when you arrived inCanada. Significant residential ties include:

Generating a Pro Forma Statement Generator For Homeowners Pro forma statement

Complete Schedule RC66SCH, Status in Canada and Income Information for the Canada Child Benefits Application, depending on your immigration and residency status Mail forms RC66 and RC66SCH to your tax center along with any required schedules and documentation as soon as possible after you and your child arrive in Canada

新移民到加拿大后如何报税 知乎

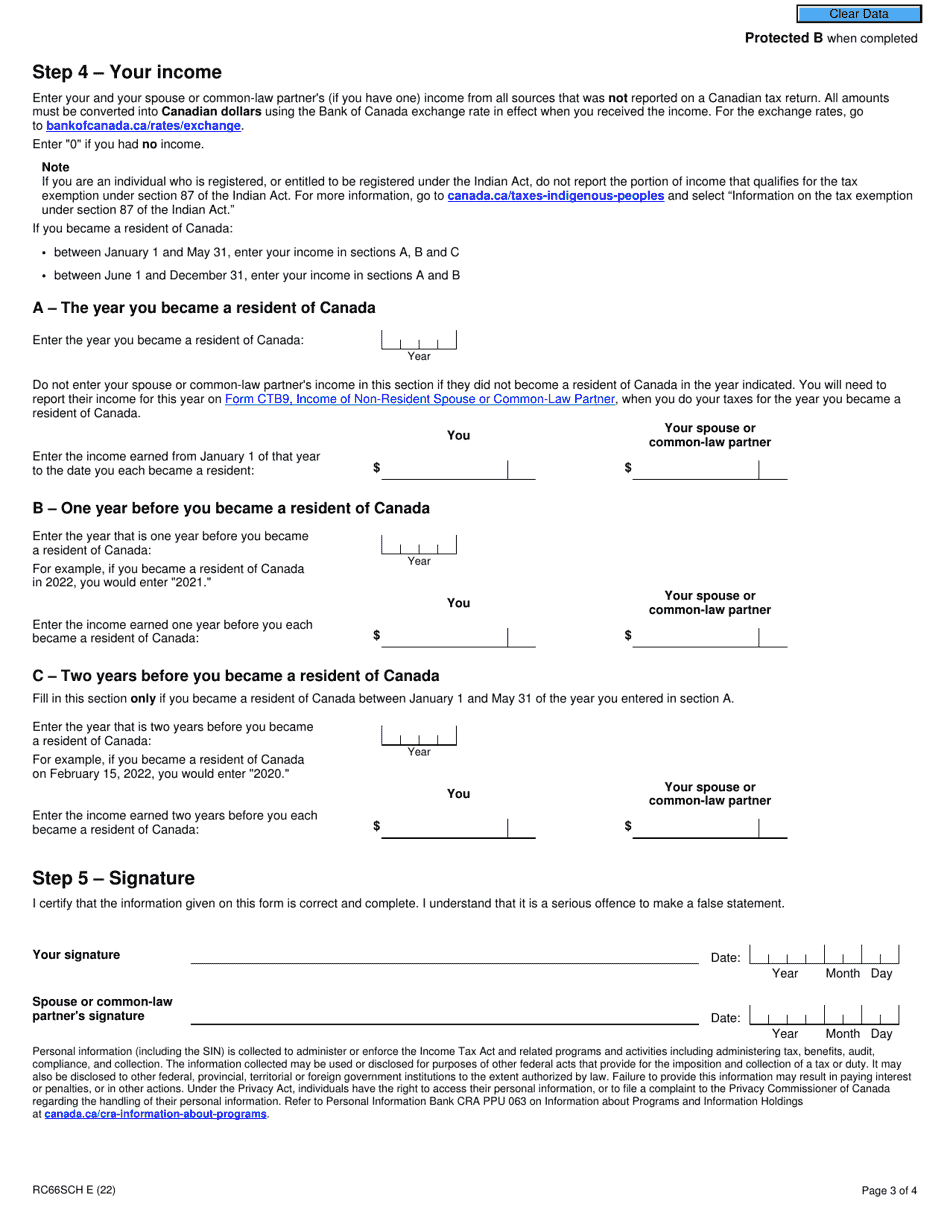

Part D - Statement of income. Complete this part if you or your spouse or common-law partner became a new resident of Canada or returned as a resident of Canada. Enter all income in Canadian dollars from all sources inside and outside Canada. Do not include income that you, your spouse or common-law partner have reported on a Canadian tax return.

Multi Step Statement Template Shooters Journal Statement template, statement

1. Apr 23, 2018. #1. Hello, Since we are returning residents, we have to fill forms rc66, rc66sch & TB9, my question is related to rc66sch and will appreciate if anyone have experience with this: - In part E (Statement of Income), the form asks for the " Year you became resident of Canada" in order to declare income for that year and the two.

the printable form for an employee's statement is shown in black and white

Schedule RC66SCH, Status in Canada/Statement of Income. Send us your Form RC66 along with any required schedules and documentation as soon as possible after you and your child arrive in Canada. In addition to the CCB, you can also receive a CDB if your child meets the criteria for the disability amount and we approved

The cool Non Profit Statement Template Free Spreadsheet With Regard To Non Pro… in 2020

cra.gc.ca 9 You must also fill out and attach to your application Schedule RC66SCH, Status in Canada/Statement of Income, if you or your spouse or common-law partner: became a new resident or returned as a resident of Canada in the last two years; became a Canadian citizen in the last 12 months; are, as defined in the Immigration and Refugee Protection Act, a permanent

- Post It Dry Erase Surface

- Big Bird Sesame Street Costume

- Best Ice Packs For Hip Surgery

- Month To Month Apt Rentals

- Highland Pines Trailers For Sale

- How To Apply For Reconsideration Ircc

- Schéma De Branchement D Une Génératrice

- Cours De Peinture Acrylique Débutant

- Alpha Marathon Film Extrusion Technologies

- Quarry Ridge Homes For Sale